FX Products

SAICMB Australia is a registered Financial Services provider regulated by ASIC (AFSL 429443)

SAICMB Australia was established in 2010 servicing the inter dealer market in foreign exchange and interest rate related products.

With a wealth of over 50 years combined experience in financial markets we have built up sound relationships with liquidity providers passing on the benefit to our customers.

SAICMB has partnered with Velocity Trade to help facilitate our clients with their foreign exchange transactions.

SAICMB provides transparency on customise rates to our clients as well as general advice before the conclusion of their financial transaction.

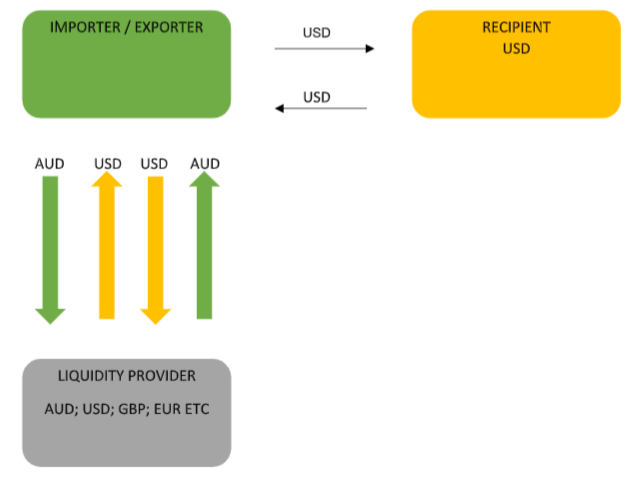

Importer transfers funds (AUD) to our Licensed Liquidity Provider. The AUD currency is exchanged at a rate agreed by both the Importer and the Liquidity Provider back to the Importers Multi-Currency Account. The Importer will then pay the recipient.

Foreign Currency is transferred to the Licensed Liquidity Provider from their Multi-Currency Account, the Currency is exchanged at a rate agreed by both the Exporter and the Liquidity Provider back into the Clients AUD Currency account.